Residential lending powers ahead with double-digit growth

Share the News

The Australian Prudential Regulation Authority (APRA) has released its June quarter 2025 ADI Property Exposures Statistics, giving the clearest snapshot yet of how mortgage markets are tracking. The numbers confirm what brokers and lenders have been seeing on the ground: lending momentum is running hot, particularly in residential property.

Ready to explore your home loan or refinancing options? Get started with Broker.com.au today

In a recent article published by Broker Pulse by Agile Market Intelligence, the standout growth trends are across both the owner-occupier and investor segments of the residential lending sector.

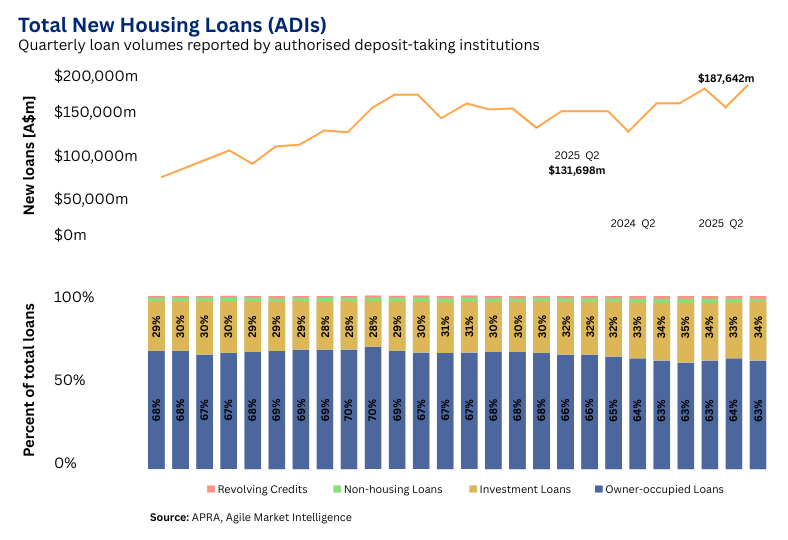

The headline numbers:

- Total outstanding residential loans now sit at $2.39 trillion, up 5.7% year-on-year.

- $187.6 billion in new lending was written during the June quarter, a 16.2% increase compared with last year.

- Investors made up 34.1% of new loan flows, almost unchanged from a year earlier

Strong activity in new housing finance

At Broker.com.au, we have divisions that help clients with home loans, as well as any business lending. And although business lending has certainly increased year on year (we see around 6% growth), it really does pale in comparison to the home lending growth we are seeing. The jump in new residential loan commitments, which surged 16.2% over the year, far outpaced the slower growth in overall credit. This points to a market where refinancing, upgrading, and new purchases remain active drivers of demand.

Owner-occupier lending retained the majority share, sitting at 63.6% of new originations (steady on the prior year). Meanwhile, investment loans held firm at just above 34%, their strongest share since APRA began reporting quarterly exposures.

Matt Board, CEO of Broker.com.au, said:

“We are seeing a lot of investors deploying capital into residential investments, even though rates have not come down too much. And with the government bringing forward the first home buyer scheme to 1st October, you can bet your bottom dollar that the $500k to $1.5m price bracket will surge over the next year. We are already seeing first home buyers getting ready to pounce.”

Whether you’re a first home buyer or investor, now’s a great time to act. Start your loan application here and see what’s possible.

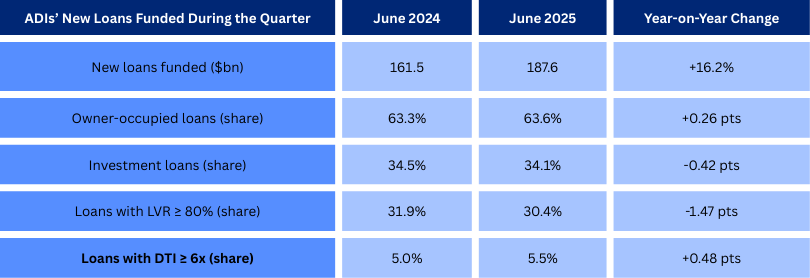

Credit quality and prudential discipline

APRA’s figures also highlight ongoing caution from lenders when it comes to risk management:

- High LVR loans (over 80%) eased back to 30.4% of new flows, down from 31.9% last year.

- High DTI loans (above 6x income) edged higher to 5.5%, up from 5.0% in 2024.

Banks continue to strike a balance between prudence and flexibility. The reduced share of high-LVR lending reflects conservative credit settings, while the small uptick in high-DTI lending remains within the band seen over the past two years.

As Matt notes:

“Although the banks are not really moving on their buffers, there are some non-banks with competitive rates who are. But with that said, the banks are looking at DTI ratios a bit more which can allow for some more flexibility when it comes to LVR’s for investors.”

Commercial property lending gains momentum

It’s not just residential lending that’s on the rise. Commercial property finance also chalked up strong growth:

• Outstanding exposures lifted 9.4% year-on-year to $464.1 billion.

• Banks’ total exposure limits rose 9.0% to $498.9 billion.

This increase shows lenders are not only maintaining their appetite for commercial property but actively expanding it.

“Not just with banks, but if we include the ever growing non-bank/private lending market for the commercial property space, then this segment of the property market is definitely growing. And in some cases, for the right assets, we are seeing LVR’s rising from a lot of lenders”, Matt said.

At Broker.com.au, we’re here to guide you through today’s fast-moving property finance landscape. Whether you’re a first home buyer, upgrading, refinancing, or exploring investment opportunities, our team can help you make sense of the numbers and choose the right lending solution for your goals. Reach out to us anytime — we’re ready to support your next move.

1300 373 300 | [email protected]

For more expert insights on business lending, industry trends, and financial strategies, check out our full Media and News page.

Take the next step toward your property goals — apply online now

and let Broker.com.au help you secure the right finance solution.