The essential guide for navigating the commercial loan and private lending landscape. This guide aims to provide easy to understand information on commercial loans and things to expect form the private lending landscape.

Please note, this is a guide only. Any borrower should always seek legal advice from appropriately qualified and experienced professionals. The team at Broker.com.au are happy to introduce you to a number of professionals in the space to help with your purchase journey.

Congratulations! The lender’s letter of offer has been signed. Here’s what to do next to move forward smoothly.

Ready to explore your own commercial loan options? Start your application with Broker.com.au today and take the next step with confidence.

Next Steps

Examine Your Offer

Take time to thoroughly review the lender’s letter of offer. Look for a list of required documents and any conditions that must be met before the loan can finalise. Start preparing early! Check out our suggestions on page 10 under ‘What Lenders Need Before Settlement’ for guidance.

Choose a Legal Expert

Private lenders typically mandate that commercial borrowers and guarantors seek independent legal advice before signing loan agreements. The lender often expects the advising lawyer to verify the borrower’s or guarantor’s identity, certify their ID, and witness the signing of the loan documents. Select a lawyer with expertise in representing commercial borrowers and guarantors to ensure you’re well-supported.

Receive and Review Loan Documents

Request that your lawyer forward the loan documents to you for a detailed review. Confirm that all terms align with the letter of offer. Pay close attention to:

- The interest rate and any default interest rate, noting whether they apply monthly or annually.

- What constitutes an event of default and the potential consequences if triggered.

- The specific property or assets offered as security for the loan—ensure it’s clear whether it’s a single property or all assets owned by the borrower and guarantor. Refer to pages 12-13 for insights on ‘Common Default Triggers in Private Commercial Loans.’ Jot down any unclear clauses to discuss with your lawyer during their advice session.

Provide Identification

The lender will require:

- The full name and birth date of the borrowing company’s director(s), verified with an ASIC company search, current driver’s licence, and passport.

- The full name and birth date of the guarantor(s), confirmed with a current driver’s licence and passport.

- The full name of the registered owner(s) of the mortgaged property, checked via a title search.

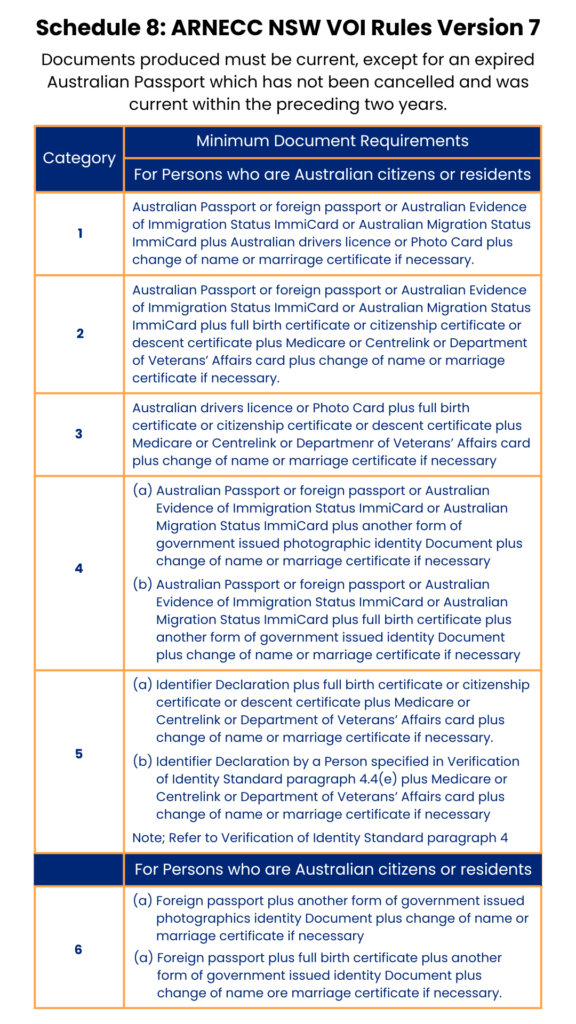

- If the loan is under a trust, the exact names of the trustees as per the trust deed. Your lawyer will need your current driver’s licence and passport for identification. If these aren’t available, alternative acceptable documents exist— see at the bottom of this guide, ‘Schedule 8 from the ARNECC NSW VOi Rules,’ for options. For further identity verification details, visit: https://www.registrargeneral.nsw.gov.au/publications/nsw-participation-rules. Ensure your ID matches records with ASIC, title searches, trust deeds (if applicable), and loan documents. If discrepancies arise (e.g., a married name or missing middle name), inform your lawyer early to prepare a ‘One and the Same Person’ statutory declaration to avoid delays.

Finalise Signing and Witnessing

After receiving legal advice, you (as the borrower and guarantor) must sign the loan documents, with your lawyer acting as the witness. Documents are typically sent electronically, allowing for quick e-signatures, which helps ensure no pages are missed and speeds up the process.

Don’t wait until the last minute—apply now through Broker.com.au and get support every step of the way to settlement.

Settlement via PEXA

Settlement occurs on PEXA, a digital platform involving multiple parties. If refinancing, the old lender (outgoing mortgagee) will remove the existing mortgage, the new lender (incoming mortgagee) will register a new one, and any caveator agreeing to withdraw their caveat will submit a removal. PEXA enables simultaneous fund transfers and Land Registry updates. If the lender requires payment of outstanding land tax, water rates, or council rates, these can be settled directly from the loan funds. You’ll either find a breakdown of fund allocations in the e-signed documents or approve it just before settlement.

Post-Settlement Actions

Verify that any excess loan funds are transferred to your specified account. Note the loan’s expiration date on your calendar and set a reminder at least a month prior. If it falls on a weekend or public holiday, plan repayment for the previous business day. Regularly review the loan terms to stay compliant and avoid defaults. If the agreement allows for extending the loan term or adjusting the amount, coordinate with your solicitor well before the deadline to prevent default.

Lender’s Preconditions for Settlement

The letter of offer may list ‘Conditions Precedent’—tasks you must complete before the lender releases funds. Acting promptly is crucial for a smooth settlement. Common requirements include:

- Agreeing to cover the cost of a property valuation arranged by the lender.

- Providing a certified trust deed copy if borrowing through a trust, proving the director’s trustee status and borrowing authority.

- Securing independent legal advice on the loan documents.

- Submitting your mortgaged property insurance policy with payment proof, listing the lender as an interested party (some prefer at least 8 months remaining on the policy).

- Supplying the latest council rates notice with payment evidence for the mortgaged property.

- Providing the latest water rates notice with payment evidence.

- Obtaining a land tax clearance certificate to confirm no outstanding land tax if the property is registered. Check with your state’s revenue office beforehand to clear any dues or inform your solicitor of amounts owed:

○ NSW: Revenue NSW (https://www.revenue.nsw.gov.au/ or 1300 139 816)

○ VIC: State Revenue Office Victoria (https://www.sro.vic.gov.au/ or 13 21 61)

○ QLD: Office of State Revenue Queensland (https://qro.qld.gov.au/ or 1300 300 734)

○ SA: Revenue SA (https://www.revenuesa.sa.gov.au/ or (08) 8226 3750, opt. 2)

○ WA: Dept of Finance WA (https://apps.osr.wa.gov.au/ or 08 9262 1200)

○ TAS: State Revenue Office of Tasmania (https://www.sro.tas.gov.au/ or 03 6166 4400)

○ ACT: ACT Revenue Office (https://www.revenue.act.gov.au/ or 02 6207 0028) Some lenders insist on clearing council rates, water rates, and land tax before settlement or deducting outstanding amounts from the loan proceeds, as these are property-attached debts prioritised over the lender in case of default or sale.

Common Default Triggers for Private Commercial Loans

When a default occurs, the lender may:

- Apply a higher default interest rate.

- Demand immediate repayment of all outstanding amounts.

- Initiate enforcement actions to take possession of the secured property if repayment fails. Watch for these typical triggers:

- Payment Issues: Missing principal, interest, or other payments due under the loan agreement, or failing to repay when required.

- Insolvency Risks: Borrower or guarantor becoming insolvent, unable to pay debts, or facing appointment of a receiver, administrator, liquidator, or similar officer over assets, or entering bankruptcy or insolvency proceedings.

- Misrepresentation: Discovering any statement, representation, or warranty by the borrower or guarantor was significantly inaccurate or misleading.

- Security Problems: Loss of the lender’s security interest’s validity, or unauthorised disposal of secured assets by the borrower.

- Ownership Changes: Significant shifts in the borrower’s or guarantor’s ownership or control without lender approval.

- Legal or Regulatory Issues: Loss, revocation, or expiration of necessary business licenses, permits, or approvals, or governmental actions restricting the borrower’s obligations.

- Business Cessation: The borrower stopping operations or making major business changes without lender consent.

- Illegal Actions: The borrower engaging in fraudulent or unlawful activities.

Selecting a Commercial Mortgage Lawyer

Consider these qualities in a lawyer:

- Specialisation exclusively in representing commercial borrowers, with deep knowledge of private lenders and mortgage law.

- Competitive fixed fees to encourage efficient settlement.

- Commitment to ensuring you fully grasp all terms.

- Willingness to travel to you in Sydney for ID verification and signing, even after hours.

- Capability to conduct remote Verification of Identity (VOi) if you’re outside Sydney.

- Readiness to witness e-signatures via a Teams meeting with split-screen verification if approved by the lender and you’re outside Sydney.

- Proactive follow-up to resolve issues and expedite settlement.

- A small, adaptable, highly specialised firm dedicated to meeting deadlines and ensuring timely loan completion.

The team at Broker.com.au. are highly experienced in successfully settling commercial property loans and transactions, and have a fantastic panel of lawyers to recommend should you require help finding the right law firm to represent you and your unique situation.

Whether you’re navigating your first commercial loan or refinancing an existing one, Broker.com.au is here to help. Get started on your loan application today