Australia and China share one of the most significant trade relationships in the Asia-Pacific region. While the headlines often focus on Australia’s exports of iron ore, coal, and agricultural products to China, a quieter but equally important story exists in the opposite direction: Australian businesses that import goods and products from China. From consumer electronics to textiles, machinery to building materials, imports from China form the backbone of many industries in Australia.

For business owners who rely on importing, access to trade finance is not just a convenience—it is a necessity. Yet, many find the process confusing, restrictive, and out of reach when dealing with traditional lenders. That is where Broker.com.au provides a critical edge: access to lending partners who can arrange facilities that are unsecured and do not require personal directors’ guarantees, backed by technical knowledge and years of experience.

Start your application today and explore flexible trade finance options here.

1. The Scale of Imports from China and Their Contribution to Australia’s Economy

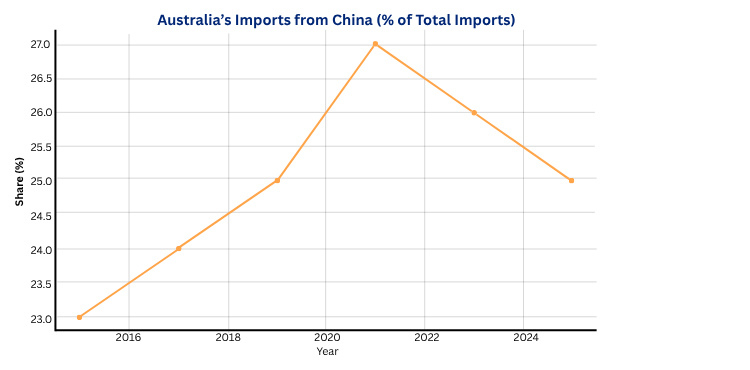

China is Australia’s largest source of imported goods, consistently making up more than 25% of Australia’s total imports over the last decade. According to data from the Australian Bureau of Statistics (ABS), the value of imports from China regularly exceeds $100 billion annually, spanning categories such as telecommunications equipment, clothing and footwear, medical devices, furniture, and industrial machinery.

2. How Many Australian Businesses Import from China?

The ABS has reported that approximately 250,000 Australian businesses are engaged in importing goods. While not all import from China, a large proportion—estimated at 40% to 45%—have China as their primary or secondary source. This equates to well over 100,000 Australian businesses directly dependent on Chinese suppliers.

If your business imports from China, you can apply for tailored trade finance solutions here.

3. The Challenge of Trade Finance: Security, Guarantees, and Risk

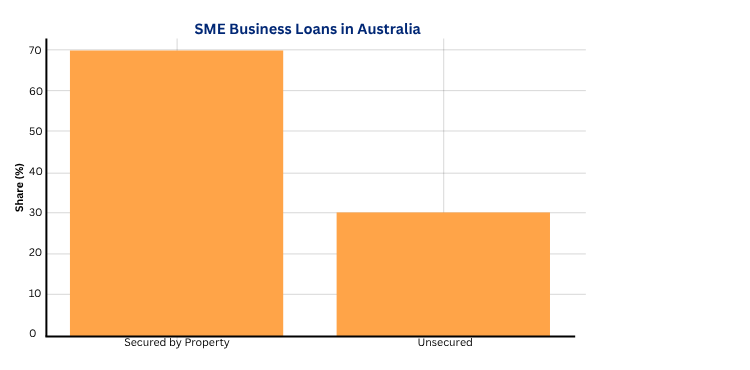

While the opportunity in importing is immense, one of the hardest realities businesses face is accessing appropriate trade finance. Traditional lenders—particularly the major banks—are cautious to the point of being restrictive.

4. How Broker.com.au Provides a Solution

This is where Broker.com.au stands apart. Our team has cultivated direct access to lender contracts that break the mould of traditional trade finance. Specifically, we can arrange facilities that are unsecured and do not require directors’ guarantees, tailored to the timing of import cycles, and approved faster than banks can manage.

The Broker.com.au Difference

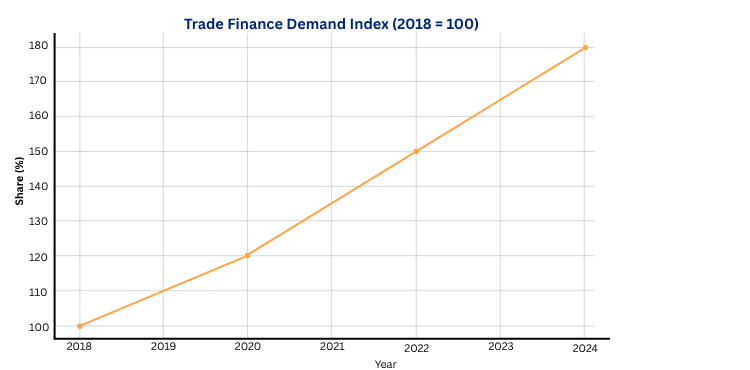

Importing from China is not just an option for Australian businesses—it is a necessity for competitiveness in many industries. With over 100,000 businesses relying on Chinese imports and the sector contributing an estimated 4–5% of GDP, the scale is undeniable.

The challenge has always been financing. Traditional lenders demand property security and personal guarantees, making trade finance inaccessible to many of the very businesses that need it most.

Broker.com.au changes that equation. By providing access to lenders who offer unsecured facilities without directors’ guarantees, combined with our technical expertise and deep market knowledge, we empower Australian businesses to import with confidence and grow without unnecessary constraints.

Ready to unlock smarter trade finance solutions? Apply now through our simple online form here.