1. Introduction

For many Australians, the dream of financial security starts and ends with owning their home outright. It’s a milestone that represents safety, stability, and peace of mind. And for good reason — without a mortgage hanging over your head, your monthly expenses drop, and you gain greater financial freedom.

But here’s a thought: what if there was a way to pay off your home loan faster and build wealth at the same time? Instead of simply focusing on shrinking the mortgage, could your money be put to work in a way that accelerates your journey toward financial independence?

That’s where debt recycling comes in.

Debt recycling is a structured, long-term strategy designed to gradually convert your non-tax-deductible home loan into tax-deductible investment debt. The idea is simple in theory, but powerful in practice — you use the equity in your home to invest in income-producing assets, then channel the returns and tax benefits into paying down your mortgage. Over time, you end up with a reduced home loan and a growing investment portfolio.

It’s a strategy that blends debt reduction with wealth creation — something many people assume can only be done one at a time. And while it’s not for everyone, for the right homeowner, it can be a game-changer.

Want to explore whether debt recycling could work for your financial future? Get Started with Broker.com.au today.

Here at Broker.com.au, we’ve seen debt recycling help clients shorten their loan terms by years, while also building investment portfolios they never thought they could afford. The key, however, is in the planning, loan structure, and discipline. Without these, debt recycling can turn from a smart strategy into an expensive mistake.

In the following sections, we’ll break down exactly how debt recycling works, when it’s worth considering, the benefits, the risks, and real-life examples that show its potential in action. Whether you’re a homeowner looking to accelerate your mortgage payoff or an investor ready to expand your asset base, this guide will give you the insights you need to decide if debt recycling could be part of your financial future.

2. How Debt Recycling Works

At its heart, debt recycling is about taking something most homeowners see as a financial burden — their mortgage — and turning it into a tool for building long-term wealth.

To understand how it works, you first need to know the difference between non-tax-deductible and tax-deductible debt:

- Non-tax-deductible debt: Your standard home loan. Because it’s used to buy your primary residence (which doesn’t generate income), the interest can’t be claimed as a tax deduction.

- Tax-deductible debt: Debt used to invest in income-producing assets like shares, managed funds, or rental property. Because these investments are designed to generate income, the interest on the loan is generally tax-deductible under Australian tax law.

Debt recycling works by gradually replacing your non-deductible debt with deductible debt.

The Core Process

Here’s the basic flow, without getting too technical:

- Pay down a portion of your mortgage — either through savings, investment income, or extra repayments.

- Reborrow the same amount from a separate loan facility, secured against the equity in your home.

- Invest the borrowed funds in assets that can generate income — for example, blue-chip shares paying dividends, an ETF portfolio, or a managed fund.

- Channel investment returns and tax refunds into further paying down your mortgage.

- Repeat the process over time until your non-deductible mortgage is significantly reduced or eliminated.

This creates a self-reinforcing loop: each cycle reduces your mortgage and increases your portfolio, which in turn produces more income to reduce your mortgage even faster.

Why It’s Different from Simply Investing

If you simply invest spare money without touching your mortgage, you still keep the full burden of your non-deductible debt. Debt recycling focuses on converting that debt so you gain a tax advantage while also building investments.

Think of it as financial multitasking:

- Pay off your mortgage ✔

- Build an investment portfolio ✔

- Potentially lower your tax bill ✔

The Role of Loan Structuring

The success of debt recycling hinges on keeping your investment loan separate from your home loan. Mixing them in the same loan account can cause serious headaches at tax time and may even make the interest on the investment portion non-deductible.

At Broker.com.au, we help clients set up their loans so:

- Home loan repayments and investment loan repayments are tracked separately.

- Interest deductibility is crystal-clear for the ATO.

- There’s flexibility to access equity without affecting the home loan’s stability.

Why This Works Over Time

Debt recycling benefits from compounding — both in investment growth and in tax savings. In the early years, the changes might feel modest. But as your investment income and tax deductions grow, you’re able to make larger and more frequent repayments on your home loan. This speeds up the cycle and, in some cases, can cut years off your mortgage while creating a substantial asset base for retirement or other goals.

If you’re clear on the “what” and “why” of debt recycling, the next step is to see the full loop in action — which we’ll cover in Section 3: Debt Recycling Loop Explained, including the exact steps homeowners follow to make the strategy work in the real world.

Ready to structure your loans the smart way? Take the first step and apply with Broker.com.au.

Mini Case Study: Michael’s Debt Recycling Kick-Off

Michael’s Starting Point:

- Home value: $750,000

- Remaining mortgage: $400,000

- Offset account savings: $60,000

- Goal: Pay off the mortgage faster and start investing without waiting until the loan is gone.

Step 1 – Reducing Non-Deductible Debt

Michael uses $40,000 from his offset account to make a lump-sum repayment on his home loan. This immediately lowers his mortgage from $400,000 to $360,000.

Step 2 – Accessing Equity for Investments

He then sets up a separate investment loan for $40,000, secured against his home. This is a distinct facility, not mixed in with his home loan.

Step 3 – Putting Money to Work

Michael invests the $40,000 in a diversified portfolio of blue-chip shares and ETFs. These investments are expected to produce about 4% in annual dividends ($1,600) plus potential capital growth.

Step 4 – Recycling the Returns

The $1,600 in dividends, combined with a $640 tax refund from the deductible investment loan interest, gives Michael $2,240 in extra cash. He puts all of this straight into his mortgage as an additional repayment.

Step 5 – Repeat the Cycle

A year later, Michael repeats the process with another $40,000 chunk — again reducing his mortgage first, then reborrowing and investing. Each cycle slightly increases his investment income and accelerates his mortgage repayment schedule.

The Outcome Over Time

After 10 years, Michael has:

- Significantly reduced his home loan balance.

- Built an investment portfolio worth hundreds of thousands of dollars.

- Created a tax-efficient debt structure that works in his favour rather than against him.

This example shows that debt recycling isn’t about taking one big leap — it’s about small, repeatable steps that compound over time.

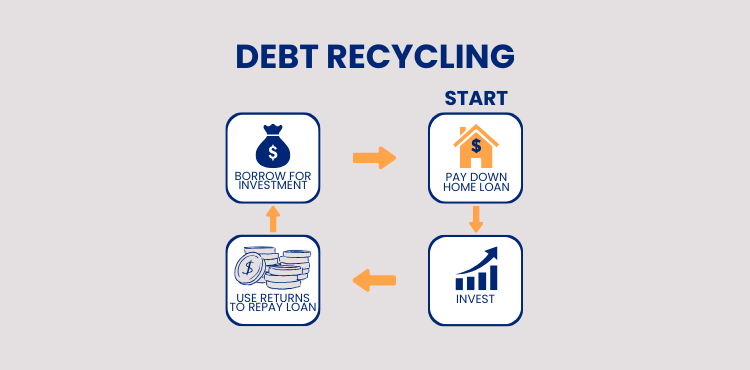

3. Debt Recycling Loop Explained

Debt recycling works best when you see it as a continuous loop rather than a one-off event. It’s a cycle you repeat over and over until you’ve converted as much of your mortgage as you feel comfortable with into tax-deductible investment debt.

Below is the step-by-step breakdown of how the loop works in practice.

Step 1 – Pay Down Your Mortgage

The starting point is reducing your non-tax-deductible home loan. You can do this through:

- Lump-sum repayments from savings or bonuses.

- Investment income from previous cycles.

- Tax refunds generated from earlier deductible debt.

- Surplus monthly cash flow.

Why this matters: Every dollar you pay off your mortgage frees up equity you can then use for investing.

Step 2 – Reborrow the Same Amount

Once you’ve reduced your mortgage, you take out a separate loan (or increase an existing investment facility) for the exact amount you just paid down. This is crucial because:

- It keeps your investment and home loans separate (important for tax purposes).

- It ensures you’re not increasing your overall debt level, just changing the type of debt.

Example: If you pay $30,000 off your home loan, you reborrow $30,000 from a separate facility for investing.

Step 3 – Invest in Income-Producing Assets

The reborrowed funds are then invested in assets designed to generate income, such as:

- Shares & ETFs – Potential for dividends and capital growth.

- Managed Funds – Professional portfolio management with regular distributions.

- Property – Rental income and long-term capital growth (though property may require larger lump sums and higher borrowing).

Key rule: The funds must be used exclusively for income-producing investments to qualify for interest deductibility under ATO rules.

Step 4 – Use Returns to Pay Down Your Mortgage

This is the “recycling” part. The income generated from your investments — along with your tax savings — is redirected straight into paying down your home loan.

- Dividends, distributions, or rental income can be deposited directly into your mortgage or offset account.

- Your annual tax refund from deductible interest can also go towards mortgage repayments.

Over time, these extra repayments reduce your non-deductible debt faster than regular repayments alone.

Step 5 – Repeat the Process

Once you’ve paid down more of your mortgage, you reborrow that amount again to invest — and the loop continues.

- Each cycle increases your investment portfolio.

- Your investment income grows with each new asset purchase.

- Your mortgage shrinks faster thanks to the additional repayments.

The Compounding Effect

The beauty of this loop is in the compounding benefits:

- Financial compounding – Your investments grow and generate more income each year.

- Debt compounding in reverse – Your non-deductible debt shrinks more quickly, reducing interest costs on your mortgage.

Over 10–15 years, the difference between doing nothing and running a disciplined debt recycling strategy can be hundreds of thousands of dollars in both reduced debt and increased investments.

Why Structure Matters

If you mix your investment and home loan funds in the same account, the ATO may disallow your interest deductions. That’s why loan structuring is the backbone of debt recycling — something we at Broker.com.au handle with precision to keep everything tax-compliant and simple to manage.

4. Example 1: Shares & ETFs

This example shows how debt recycling can work for a homeowner focused on building a share and ETF portfolio over time. The numbers are realistic, but for illustration purposes only — real-world results will vary based on market performance, interest rates, and individual discipline.

The Starting Point

- Home value: $900,000

- Remaining mortgage: $450,000 (non-tax-deductible)

- Offset account savings: $80,000

- Annual household income: $150,000

- Goal: Reduce mortgage from $450k to zero while building a $500k investment portfolio within 15 years.

Year 1 – The First Cycle

Step 1 – Pay Down Mortgage

They use $50,000 from the offset account to make a lump-sum repayment.

Mortgage drops to $400,000.

Step 2 – Reborrow for Investing

A separate investment loan of $50,000 is established.

Step 3 – Invest in Shares & ETFs

The $50,000 is invested in a diversified portfolio of:

- 60% Australian shares (dividend yield ~4%)

- 40% global ETFs (dividend yield ~2%)

Step 4 – Recycle the Returns

- Dividends in Year 1: approx. $1,800 after reinvestment decisions.

- Tax refund from interest deduction: approx. $800.

- Total recycled into mortgage: $2,600.

Year 5 – Momentum Builds

By the fifth year:

- They’ve repeated the cycle three more times, each time using dividends, tax refunds, and surplus income to pay an extra $50k into the mortgage before reborrowing and investing.

- Portfolio size: approx. $230,000.

- Annual investment income: approx. $8,500.

- Annual tax refund from investment loan interest: approx. $3,200.

- Extra mortgage repayments from recycling: over $11,000 each year.

The mortgage has now dropped to around $250,000.

Year 10 – The Snowball Effect

By Year 10:

- Portfolio size: approx. $420,000.

- Annual investment income: approx. $16,000.

- Annual tax refund: approx. $5,500.

- Combined annual recycling into mortgage: $21,500.

Mortgage balance now: approx. $90,000.

Year 13 – Mortgage Cleared

By the 13th year, the mortgage is fully paid off — two years ahead of their original 15-year target.

- Investment portfolio: approx. $520,000 (continuing to grow without any extra borrowing).

- All former mortgage repayments are now surplus cash flow that can be directed entirely into further investments, super contributions, or lifestyle goals.

Key Takeaways

- Discipline is Everything – The strategy only works if all returns are recycled into debt reduction, not spent.

- Market Performance Matters – Share markets can fluctuate, so short-term volatility must be expected.

- Tax Benefits Compound – Each year’s tax refund adds to the mortgage repayment power.

- Time is the Secret Ingredient – The real magic happens after 7–10 years when compounding starts to accelerate both debt reduction and portfolio growth.

5. Example 2: Property-Focused

While many people associate debt recycling with shares and managed funds, the strategy can also be applied to investment property. The principles are the same — convert non-deductible mortgage debt into deductible investment debt — but the income source changes from dividends to rental payments.

The Starting Point

- Home value: $1.1 million

- Remaining mortgage: $600,000 (non-tax-deductible)

- Equity available: $500,000

- Annual household income: $180,000

- Goal: Pay off the home loan while acquiring an investment property that delivers long-term rental income and capital growth.

Year 1 – First Cycle

Step 1 – Reduce Non-Deductible Debt

They use $100,000 from savings and an inheritance to make a lump-sum repayment, lowering their mortgage to $500,000.

Step 2 – Reborrow for Investment

They set up a separate investment loan for $100,000.

Step 3 – Purchase Investment Property

The $100,000 becomes the deposit for a $500,000 investment property, with the remainder funded through a standard investment property loan.

- Expected rental yield: 4.5% ($22,500 per year).

- Annual interest on the $100,000 investment loan: $6,000 (tax-deductible).

Step 4 – Recycle the Returns

- Net rental income after expenses: approx. $8,000/year.

- Tax refund from deductible interest: approx. $2,400.

- Total extra mortgage repayment: $10,400 in Year 1.

Year 5 – Scaling the Strategy

By the fifth year:

- They’ve repeated the cycle twice more, using lump-sum mortgage payments and reborrowing to cover further investment property deposits.

- Portfolio: 3 properties worth a combined $1.6 million.

- Total net rental income: approx. $26,000/year.

- Annual tax refund from investment loans: approx. $7,500.

- Combined annual recycling into mortgage: $33,500.

Mortgage balance now: approx. $280,000.

Year 10 – Accelerated Payoff

By Year 10:

- Portfolio: 4 properties worth approx. $2.1 million.

- Net rental income: approx. $44,000/year.

- Annual tax refund: approx. $11,500.

- Combined mortgage recycling: $55,500/year.

Mortgage balance: approx. $20,000.

Year 11 – Mortgage Cleared

With just one final repayment cycle, the mortgage is completely cleared. The homeowner now:

- Owns their home outright.

- Holds 4 investment properties producing a combined net income of ~$50,000/year (before tax).

- Has an asset base that can continue to grow in value over time.

Key Points About Property-Focused Debt Recycling

- Bigger Equity Requirements – Property deposits are larger than share purchases, so bigger repayments or lump sums are needed for each cycle.

- Rental Income is Less Volatile – While shares can have fluctuating dividends, rental income tends to be more stable, though vacancy periods must be managed.

- Capital Growth Potential – Property values can rise significantly over the long term, adding an extra layer of wealth creation.

- Cash Flow Management is Crucial – Properties involve expenses like maintenance, insurance, and rates — these must be factored into the strategy.

6. Who Should (and Shouldn’t) Consider It

Debt recycling can be a powerful wealth-building tool, but it’s not a one-size-fits-all strategy. Like any financial approach that involves borrowing to invest, it requires the right mix of financial stability, mindset, and risk tolerance.

Who It’s Best Suited For

Debt recycling often works well for people who:

- Have Significant Home Equity

You’ll need enough equity to support the reborrowing required for investments. For example, if your home is worth $900,000 and your mortgage is $400,000, you’ve got $500,000 in equity to work with.

- Earn a Stable, Predictable Income

A consistent salary or business income means you can meet both your mortgage and investment loan repayments without strain. This is especially important if interest rates rise or investments underperform.

- Have a Long-Term Mindset

Debt recycling isn’t a quick win — it’s typically a 10–20 year journey. Those who stick with it through market ups and downs tend to see the best results.

- Are Comfortable with Investment Risk

You must be okay with the reality that investments can go up and down. Short-term losses shouldn’t derail your commitment to the strategy.

- Have Good Financial Discipline

All investment returns and tax refunds need to be directed back into your mortgage, not spent. The strategy fails if you treat the extra income as “fun money.”

Who Should Probably Avoid It

Debt recycling may not be suitable if you:

- Have Unstable Income

If your job security is uncertain or your earnings fluctuate heavily, taking on extra debt can add unnecessary stress.

- Are Highly Risk-Averse

If the idea of seeing your investments drop in value keeps you awake at night, this strategy might cause more worry than it’s worth.

- Are Close to Retirement

If you don’t have at least 7–10 years to ride out market cycles, debt recycling may not have enough time to deliver meaningful results.

- Struggle with Budgeting

If you tend to overspend or find it difficult to stick to a financial plan, the discipline required for debt recycling could be challenging.

- Already Have High Personal Debt

Credit card balances, personal loans, and other high-interest debt should be cleared first before considering any form of leveraged investment.

Broker.com.au Insight

In our experience, the clients who do best with debt recycling aren’t necessarily investment experts — they’re simply consistent, disciplined, and have a clear goal in mind. The right structure, combined with a tailored investment approach, allows them to confidently stay the course even when markets wobble.

7. The Benefits of Debt Recycling

The appeal of debt recycling lies in its ability to help you pay off your home loan faster while building wealth at the same time. For many Australians, that combination is far more powerful than simply focusing on one goal at a time.

Here are the main advantages that make this strategy so attractive.

1. Tax Efficiency

Your home loan is a non-tax-deductible debt — meaning every dollar of interest you pay comes straight out of your pocket. By gradually replacing it with an investment loan (used for income-producing assets), you turn a portion of your debt into tax-deductible interest.

Example:

If you borrow $100,000 to invest and your interest rate is 6%, that’s $6,000 in annual interest. If your marginal tax rate is 37%, you could claim a deduction worth $2,220 — effectively lowering the real cost of the loan.

2. Faster Mortgage Payoff

By funnelling investment income and tax refunds into your mortgage, you make extra repayments every year without reducing your day-to-day spending.

- Each repayment reduces your non-deductible debt.

- Each reduction increases the equity you can reborrow for more investments.

- This creates a snowball effect where each cycle accelerates the next.

3. Building an Investment Portfolio While Paying Down Debt

With traditional mortgage-first thinking, you might spend 20–30 years paying off your home before investing seriously. Debt recycling allows you to invest now — meaning your portfolio has decades to benefit from compounding.

4. Leverage

Using your home equity as security means you can invest larger sums than you might have in cash. If your investments perform well over the long term, this can significantly boost returns compared to investing small amounts from savings alone.

5. Keeping Pace with Inflation

Over the long term, property and share markets have historically outpaced inflation. By building assets now rather than waiting until your mortgage is gone, you give your portfolio more time to grow in real terms.

6. Flexibility in Investment Choices

Debt recycling isn’t limited to one type of asset. Depending on your goals, you can choose:

- Australian or global shares and ETFs.

- Managed funds.

- Investment properties.

- A mix of all of the above.

This flexibility allows you to tailor the strategy to your risk profile and time frame.

Broker.com.au Perspective

We often tell clients: debt recycling is not just about tax savings — that’s the cherry on top. The real benefit is the dual attack on your finances: shrinking your mortgage and growing your assets simultaneously. Over a decade or more, that combination can transform your financial position in ways a “pay the mortgage first” approach rarely does.

8. Risks & What Could Go Wrong

While debt recycling can be a powerful way to accelerate wealth creation, it’s not without its pitfalls. Like any leveraged investment strategy, the potential benefits come with corresponding risks. Understanding these risks is essential before committing.

1. Market Risk

What it is: The value of your investments can rise or fall. If your portfolio underperforms or suffers a loss, your debt still remains — and you must keep making repayments regardless of market conditions.

Example:

If you borrow $100,000 to invest in shares and the market drops by 20% in the first year, your portfolio could be worth only $80,000 — but you still owe the full $100,000 plus interest.

Mitigation:

- Diversify investments across asset classes and sectors.

- Commit to a long-term horizon to ride out downturns.

- Avoid panic-selling during volatile periods.

2. Interest Rate Risk

What it is: Both your home loan and your investment loan can be affected by interest rate rises. Higher repayments could strain your budget if you haven’t planned for them.

Example:

If your $200,000 investment loan rate rises from 6% to 7.5%, your annual interest bill jumps from $12,000 to $15,000 — an extra $3,000 a year.

Mitigation:

- Stress-test your budget at higher interest rates before starting.

- Keep a cash buffer or offset account to cover rising costs.

3. Income Risk

What it is: Your ability to maintain the strategy depends on your income. Job loss, illness, or reduced earnings can make it harder to meet repayments.

Mitigation:

- Maintain income protection insurance where appropriate.

- Keep an emergency fund of at least 3–6 months’ expenses.

4. Discipline Risk

What it is: The strategy fails if investment income or tax refunds are spent instead of being recycled into the mortgage.

Mitigation:

- Set up automatic transfers from your investment income and tax refunds to your mortgage account.

- Treat the process as non-negotiable — like a bill that must be paid.

5. Liquidity Risk

What it is: Some investments (like property) are harder to sell quickly if you need funds. This can be an issue in emergencies or if you want to rebalance your portfolio.

Mitigation:

- Include liquid investments like ETFs or managed funds alongside property.

- Keep a portion of your portfolio in assets that can be sold quickly if needed.

6. Legislative and Tax Risk

What it is: Tax laws and lending rules can change over time. Future government policy could alter the deductibility of interest or the availability of certain investment products.

Mitigation:

- Work with a mortgage broker and accountant who stay up to date with ATO rulings.

- Be prepared to adjust your strategy if the rules change.

Broker.com.au Perspective

We encourage clients to think of debt recycling like running a business — you’re using borrowed capital to generate income. And like any business, success depends on planning for risks, keeping tight control over cash flow, and making decisions with both good times and bad times in mind.

9. ATO Rules & Legal Considerations

One of the most important aspects of debt recycling is making sure your strategy complies with Australian Taxation Office (ATO) rules. Done properly, debt recycling is entirely legal and widely used. Done poorly, it can lead to disallowed deductions, ATO scrutiny, and even unexpected tax bills.

The ‘Purpose Test’

The ATO determines whether interest is deductible based on the purpose of the borrowed funds, not on what asset you’ve used as security.

In other words:

- If you borrow money to buy income-producing assets (e.g., shares, rental property), the interest is generally deductible.

- If you borrow to pay for personal expenses (e.g., holidays, cars, renovations to your own home), the interest is not deductible — even if the loan is secured against your house.

Keep Investment Loans Separate

The ATO is very clear: mixing personal and investment use in the same loan creates a mess.

- If you redraw from a mixed-purpose loan to fund both investments and personal expenses, you’ll need to apportion interest between deductible and non-deductible portions — a complex and error-prone process.

- Worse still, sloppy record-keeping can result in the ATO disallowing part (or all) of your deductions.

Best practice:

- Set up a separate loan facility exclusively for investments.

- Never use that facility for personal expenses.

- Maintain clear records of where every borrowed dollar went.

Investment Income Must Be Declared

Any dividends, rental income, or distributions earned from investments funded through debt recycling must be declared as taxable income. Even if you reinvest dividends via a DRP (Dividend Reinvestment Plan), they still count as income in the year you receive them.

Capital Gains Tax (CGT)

When you eventually sell an asset purchased with borrowed funds, you may be liable for CGT on any capital gain.

- The 50% CGT discount may apply if you’ve held the asset for more than 12 months.

- CGT applies regardless of whether the asset was bought through debt recycling or with cash.

Record-Keeping Requirements

The ATO expects you to keep:

- Loan statements showing the purpose of the borrowed funds.

- Purchase contracts or investment statements.

- Records of all income earned and expenses incurred.

Keeping these documents organised will make tax time straightforward and protect you in the event of an audit.

Broker.com.au Perspective

We make sure our clients’ loan structures are “ATO audit-proof” from day one. That means:

- No mixed-purpose loans.

- Full documentation of the investment purpose.

- Clear paper trails for every transaction.

By working closely with your accountant, we ensure your debt recycling strategy stays 100% compliant — so you can focus on building wealth without worrying about running afoul of the tax office.

10. Step-by-Step Guide to Starting

Debt recycling is most effective when approached with a clear, methodical plan. Below is a practical roadmap to help you start safely and efficiently.

Step 1 – Assess Your Current Financial Position

Before you do anything, take stock of:

- Home equity – The difference between your property’s value and your remaining mortgage.

- Income stability – Can you confidently meet loan repayments even if interest rates rise?

- Cash flow – Do you have surplus income each month to handle extra debt repayments if needed?

- Debt-to-income ratio – Lenders will assess this when approving an investment loan.

Tip: If you’re already stretched financially, it’s wise to stabilise your position before starting.

Step 2 – Build or Confirm an Emergency Fund

An emergency buffer protects you from having to sell investments at the wrong time.

- Aim for 3–6 months of living expenses in an offset or high-interest savings account.

- This fund should be separate from any investment accounts.

Step 3 – Increase Your Home Equity

The more equity you have, the more you can potentially reborrow. You can boost equity by:

- Making lump-sum repayments (from savings, bonuses, tax refunds).

- Increasing regular repayment amounts.

- Applying windfalls (e.g., inheritance, asset sales).

Step 4 – Set Up the Right Loan Structure

This is where the structure makes or breaks the strategy:

- Keep your home loan and investment loan in separate facilities.

- Use a split-loan arrangement or a separate line of credit for investments.

- Ensure investment loan funds are drawn directly into the investment account, never into a personal account.

Broker.com.au tip: We structure loans so they’re clean for tax purposes and flexible enough for multiple cycles of debt recycling.

Step 5 – Choose Your Investment Strategy

Your choice of investments will determine your income flow, risk profile, and growth potential. Options include:

- Shares & ETFs – Lower entry costs, regular dividends, easily diversified.

- Managed Funds – Professional management and diversification.

- Investment Property – Rental income and capital growth potential (but larger capital requirements).

Golden rule: Only invest in what you understand and can hold for at least 7–10 years.

Step 6 – Direct All Returns into Your Mortgage

The recycling part only works if all:

- Dividends

- Distributions

- Rental income

- Tax refunds from deductible interest

…are funnelled back into reducing your home loan balance.

Automating these transfers prevents “lifestyle creep” where returns get spent instead of recycled.

Step 7 – Repeat the Cycle

Once you’ve reduced your mortgage again, reborrow that amount in your investment facility and reinvest. Each loop increases your portfolio and accelerates your mortgage payoff.

Step 8 – Review and Adjust Regularly

Markets, interest rates, and personal circumstances change. Every 6–12 months:

- Review your investment performance.

- Check your loan balances and equity.

- Reassess your risk tolerance.

- Adjust investment choices if needed.

Broker.com.au Perspective

Our role isn’t just to set up the loans — we help clients map the full journey, stress-test their plan, and review it regularly. That way, the strategy stays aligned with their goals and market conditions.

11. Common Mistakes to Avoid

Debt recycling can be incredibly effective — but like any financial strategy, there are traps that can undermine its success. Many of these mistakes are avoidable with the right structure, mindset, and professional guidance.

1. Mixing Personal and Investment Debt

The problem: Using the same loan for both personal expenses and investments can destroy the tax efficiency of your strategy. The ATO requires you to apportion interest costs between deductible and non-deductible portions — and it’s messy, time-consuming, and prone to error.

Avoid it by:

- Setting up completely separate loan facilities for investment borrowing.

- Never redrawing from your investment loan for personal use.

2. Chasing High-Risk Returns

The problem: Some investors try to “supercharge” their results by investing borrowed funds into speculative assets like cryptocurrency, high-volatility shares, or unproven business ventures. If the investment tanks, you still owe the debt.

Avoid it by:

- Sticking to diversified, income-producing assets with a proven long-term record.

- Remembering that debt recycling is a marathon, not a sprint.

3. Ignoring Cash Flow Planning

The problem: Overestimating your ability to service additional loan repayments — especially if interest rates rise — can put serious strain on your household budget.

Avoid it by:

- Stress-testing your budget with rates 2–3% higher than current levels.

- Keeping a cash buffer for emergencies and unexpected expenses.

4. Spending Instead of Recycling

The problem: Using investment income or tax refunds for lifestyle upgrades instead of mortgage repayments stops the cycle in its tracks.

Avoid it by:

- Automating transfers of all investment income and tax refunds directly to your mortgage account.

5. Selling Investments Too Early

The problem: Reacting to short-term market drops by selling can lock in losses and reduce future income potential — while you still have to service the loan.

Avoid it by:

- Committing to a long-term investment horizon (minimum 7–10 years).

- Diversifying so that a single asset’s performance won’t derail your plan.

6. Neglecting to Review the Strategy

The problem: Markets, interest rates, and personal goals change over time. A “set and forget” approach can cause your plan to drift off course.

Avoid it by:

- Reviewing your debt recycling structure and portfolio at least annually.

- Adjusting investments, loan facilities, and repayment schedules when needed.

Broker.com.au Perspective

In our experience, the clients who get the best results are not necessarily the most aggressive investors — they’re the ones who stay disciplined, avoid shortcuts, and review their plan regularly. A steady, consistent approach beats a rushed, high-risk strategy every time.

12. Debt Recycling vs. Just Paying Off the Mortgage

Many homeowners ask: Why not just pay down the mortgage first, then start investing? It’s a valid question — and the answer depends on your priorities, time frame, and risk tolerance.

Below is a simplified comparison over 15 years, assuming the same starting point:

- Home value: $900,000

- Mortgage: $450,000

- Extra annual surplus: $20,000 (from salary, dividends, and tax refunds in the debt recycling scenario)

| Factor | Mortgage-First Approach | Debt Recycling Approach |

| Mortgage term | 15 years | 11–13 years (accelerated payoff) |

| Investment portfolio after 15 years | $0 (only starts after mortgage is gone) | $500k+ (portfolio grows during mortgage term) |

| Tax benefits | None | Interest on investment loan is deductible |

| Risk level | Low (no leveraged investments) | Medium (investments funded with borrowed money) |

| Wealth at year 15 | Home equity only | Home equity + large investment portfolio |

Key takeaway: The mortgage-first approach is safer and simpler, but it delays investment growth. Debt recycling starts wealth creation immediately, though it comes with added risk and complexity.

13. Case Study: Sarah & Mark (Fictional but realistic)

Starting point:

- Sarah (38) and Mark (40) own a home worth $1 million.

- Mortgage: $550,000.

- Combined income: $180,000/year.

- Savings in offset: $60,000.

- Comfortable with moderate risk and have a 20-year investment horizon.

Year 1:

They use $40,000 from savings to pay down their mortgage to $510,000.

They set up a $40,000 investment loan, which they use to buy a diversified ETF portfolio (yield 3.5%).

Year 5:

- Recycled three times.

- Portfolio worth: $180,000.

- Mortgage balance: $340,000.

- Annual investment income: $6,300.

- Tax refund from investment interest: $2,500.

- Total annual extra repayments to mortgage: $8,800.

Year 12:

- Portfolio worth: $420,000.

- Mortgage paid off completely.

- Household cash flow freed up to direct all surplus income into investments.

Year 20:

- Portfolio value: $850,000+.

- Entire home owned outright.

- Passive income from dividends: ~$30,000/year before tax.

Outcome:

By starting early, they built a substantial investment base while eliminating their mortgage, reaching financial independence years ahead of schedule.

14. Frequently Asked Questions

Q: Can I do debt recycling without selling my investments?

A: Yes. The aim is to hold onto investments for the long term and use the income and tax savings to pay off your home loan. Selling early can interrupt compounding and may trigger CGT.

Q: What if I lose my job?

A: Having an emergency fund and income protection insurance can help. You can also pause the investment cycle and focus on maintaining your existing loans until your income recovers.

Q: Can I pause the strategy if markets fall?

A: Yes. You can keep existing investments but hold off on reborrowing until conditions improve.

Q: Is property or shares better for debt recycling?

A: It depends on your capital, risk tolerance, and goals. Shares/ETFs allow smaller, more frequent cycles; property offers potentially larger gains but requires bigger deposits.

Q: Does debt recycling affect my credit score?

A: Investment loans appear on your credit file, but responsible use generally has no negative long-term effect.

15. Getting Professional Help

The success of debt recycling hinges on getting the structure right and sticking to the plan. At Broker.com.au, we:

- Assess your financial situation to ensure you’re a good candidate.

- Structure your home and investment loans for maximum tax efficiency.

- Coordinate with your accountant to keep everything ATO-compliant.

- Help you select suitable lenders and products to support your investment strategy.

- Provide ongoing check-ins to adjust your plan as your life and markets change.

Many people try to set this up themselves and end up with mixed-purpose loans, incorrect documentation, or an investment plan that’s too risky. The right advice from the start can save thousands and avoid costly mistakes.

16. Final Thoughts

Debt recycling isn’t a magic bullet — but for the right person, it’s a strategic, disciplined way to achieve two goals at once:

- Pay off your home loan faster.

- Build a long-term, income-producing investment portfolio.

The trade-off is that you take on investment risk in exchange for potentially greater long-term wealth. That’s why it’s crucial to:

- Understand the process.

- Plan your cash flow.

- Stick to the rules for loan separation and deductibility.

- Commit for the long term.

With the right structure and advice, debt recycling can be a powerful part of your financial toolkit. And when you’re ready to explore whether it’s right for you, Broker.com.au can guide you every step of the way — from setting up your loan splits to ensuring your strategy stays on track.

Disclaimer: this article is for information purposes only and should not be taken as financial advice. Please consult a qualified accountant or financial advisor for the correct guidance and what ultimately best suits your needs and requirements.

Debt recycling isn’t for everyone — but with the right structure, it can be transformational. If you’re ready to see what it could look like for you, start your application here