We have helped many people over the years acquire businesses via funding from the lenders we work with. One thing that always pops up if the structure is to acquire the shares in the company (versus say an asset sale), is whitewash. So, what is it and how could it affect you if you are going through this process?

The Whitewash Process in Business Acquisitions in Australia: A Complete Guide

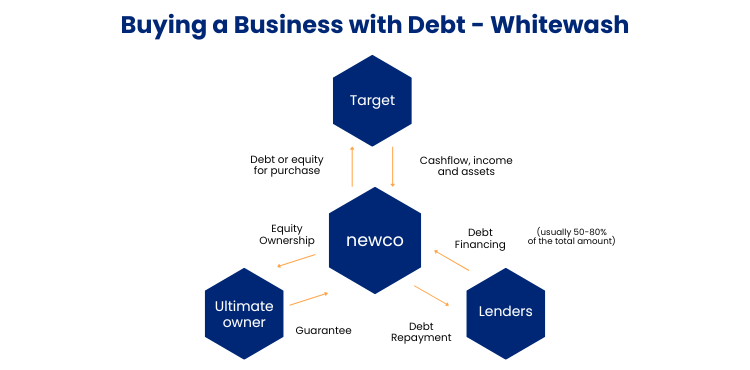

When buying a business in Australia, particularly through a leveraged acquisition, the whitewash process becomes a critical legal and compliance step. Also known as the “financial assistance whitewash,” this procedure allows a target company to legally provide financial assistance — such as using its assets as security or funds — to help the buyer acquire shares in that same company.

This detailed guide walks through what the whitewash process is, when it applies, how it works, what lawyers and lenders require, what ASIC does with whitewash submissions, and why it’s crucial for funding approval.

1. What Is the Whitewash Process?

The whitewash process is a legal procedure under the Corporations Act 2001 that permits a company to provide financial assistance to another party (usually the buyer) to acquire its own shares. Normally, this is prohibited, as it may harm the company or its creditors, but with shareholder and ASIC approval, it can be allowed under certain safeguards.

2. When Is Whitewash Required?

Whitewash is required when:

- A buyer acquires shares in a company (often via a holding company or unit trust structure).

- The target company is asked to guarantee a loan or provide security (e.g., charge over assets) to help finance its own purchase.

- The financial assistance is material, meaning it’s significant in value and has a real or potential effect on the company’s solvency or operations.

This situation commonly arises in management buyouts, private equity acquisitions, and business purchases involving debt finance.

Planning to buy a business and need finance in place? Get started with your application here and we’ll guide you through the funding process.

3. Legal Background: Section 260A of the Corporations Act 2001

Section 260A sets out three exceptions where financial assistance is allowed:

- No Material Effect Test

If the assistance doesn’t materially prejudice the company, its shareholders, or creditors.

- Shareholder Approval (Whitewash)

Approval must be given through a special resolution (75% of votes in favour) by shareholders, after proper disclosure.

- ASIC Exemption or Declaration

ASIC may exempt certain types of transactions, though this is less common.

Most acquisitions that involve debt financing fail the “no material effect” test, so whitewash under Section 260A(1)(b) is required.

4. Step-by-Step: How the Whitewash Process Works

Step 1: Legal and Financial Advice

The process begins with lawyers and accountants evaluating whether financial assistance is involved. If yes, they advise that the whitewash procedure is necessary.

Step 2: Drafting Disclosure Notice

Lawyers prepare a disclosure document that:

- Details the proposed transaction.

- Explains how the assistance is being provided.

- Includes solvency assessments.

- Addresses risks to the company and creditors.

This must be given to shareholders at least 14 days before the shareholder meeting.

Step 3: Board Resolution

The board of the target company meets and resolves to provide financial assistance, subject to shareholder approval.

Step 4: Shareholder Meeting and Special Resolution

A shareholder meeting is convened, and a special resolution (75% majority) is passed approving the financial assistance.

Step 5: Lodging Documents with ASIC

Within 14 days of passing the resolution, the company must lodge a Form 2205 with ASIC, along with:

- The disclosure document.

- The shareholder resolution.

- A covering letter from the lawyer.

Step 6: Waiting Period (14 Days)

After ASIC receives the documents, the company must wait at least 14 days before implementing the financial assistance. This is to give ASIC time to review and intervene if necessary.

Step 7: Implementation

Once the waiting period ends without objection, the company can proceed — such as by executing a guarantee or security over its assets in favour of the lender.

5. Role of the Lawyer: Safeguarding the Buyer

A commercial lawyer plays a pivotal role in:

- Determining whether the transaction requires whitewash.

- Drafting the detailed disclosure notice.

- Ensuring that director and shareholder approvals are obtained correctly.

- Confirming compliance with ASIC lodgement deadlines.

- Coordinating with financiers and other professionals.

- Advising on the legal risks if the process is skipped or mismanaged.

They also draft or review loan and security documents, ensuring that the financial assistance aligns with the whitewashed approval and doesn’t expose the buyer or company to legal challenges.

6. Lodging Whitewash Documents with ASIC

ASIC Lodgement Requirements:

- Form 2205: Notification of resolutions regarding shares.

- Copy of special resolution: Signed by the company secretary or director.

- Disclosure statement: Full outline of the financial assistance and transaction.

- Signed board minutes and lawyer’s letter, where applicable.

These are lodged via ASIC’s online portal or through an approved legal agent.

7. ASIC’s Role and Turnaround Time

What ASIC Does:

- ASIC does not “approve” the whitewash.

- It simply reviews the documentation and may intervene if:

- The process was not properly followed.

- The transaction appears unlawful or prejudicial.

- Creditor or shareholder rights are being undermined.

Turnaround Time:

- The statutory wait period is 14 days from the date of ASIC lodgement.

- If no objections or action is taken by ASIC in that time, the company is free to proceed.

- ASIC may contact the company or its lawyers during the 14-day period for clarifications.

8. Impact on ASIC Registers Post-Acquisition

After the financial assistance is implemented (e.g., the target company grants a security interest or guarantee), ASIC records may be updated to reflect:

- New charges or mortgages lodged via PPSR or ASIC forms.

- Changes to shareholding and director appointments, depending on the acquisition structure.

- Lodgement of new constitutions or shareholder agreements if relevant.

While ASIC doesn’t formally mark a transaction as “whitewashed,” the supporting documentation becomes part of the company’s compliance history.

9. Whitewash and Acquisition Funding: The Lender’s Perspective

For lenders providing funding for a business acquisition, the whitewash process is non-negotiable where financial assistance is involved.

What Lenders Require:

- Completed whitewash process and 14-day wait period observed.

- Certified copy of the special resolution.

- Legal opinion confirming compliance with Section 260A.

- Registered security over the target’s assets, post-whitewash.

Lenders will not release funds or settle the deal until they receive:

- Confirmation that the whitewash documents have been lodged with ASIC.

- Evidence that the statutory waiting period has expired with no ASIC intervention.

- Assurance that all documentation is legally enforceable.

In many cases, lender-appointed lawyers or panels will review the whitewash materials independently.

Lenders won’t release funds without the right compliance steps. Apply with Broker.com.au today and let us help secure the funding you need.

10. Risks and Common Pitfalls

Skipping the Whitewash:

Proceeding without proper whitewash can result in:

- The loan or guarantee being void or unenforceable.

- Directors being held liable for breaches of duty.

- Fines and criminal penalties under the Corporations Act.

Common Mistakes:

- Rushing the process without full disclosure.

- Not observing the 14-day wait period.

- Inadequate shareholder engagement or voting errors.

- Lodging incorrect or incomplete documentation.

Risk Mitigation:

- Engage experienced lawyers and M&A advisers early.

- Coordinate the acquisition timeline with lender milestones.

- Ensure all directors and shareholders are clear on the whitewash implications.

11. Alternatives to the Whitewash Process

While the whitewash process is often necessary, alternatives include:

- Structuring the transaction differently to avoid financial assistance (e.g., keeping the target company’s assets ring-fenced).

- Funding the acquisition entirely through equity or external collateral.

- Using non-corporate guarantors or parent entities for financing obligations.

However, these alternatives can be more complex, costly, or unattractive to lenders.

12. Final Thoughts and Professional Support

The whitewash process is a vital compliance mechanism in Australian business acquisitions involving debt finance. It ensures transparency, creditor protection, and legal enforceability of financial assistance arrangements.

If you’re planning to buy a business and intend to use the target company’s assets as security or ask it to guarantee a loan, whitewash is almost always required. While it adds procedural time and legal cost, it protects all parties and satisfies lender conditions.

Professional Help You’ll Need:

- Commercial lawyer: To handle disclosure, resolutions, ASIC lodgement, and legal opinion.

- Accountant or financial adviser: To assess solvency and financial effects.

- Finance broker: To arrange acquisition funding and liaise with lenders on documentation requirements.

Need Help with Business Acquisition and Whitewash Support?

At Broker.com.au, we work closely with specialist lawyers, lenders, and accountants to coordinate acquisitions, secure finance, and ensure your whitewash documentation is in perfect order. Whether you’re a first-time buyer or a seasoned investor, we’ll help you navigate the legal and financial complexities with confidence.

Ready to take the next step in your business acquisition? Start your application online with Broker.com.au and get expert support from day one.