A business overdraft gives your business ongoing access to short-term funds whenever you need them. Instead of receiving a lump sum like a traditional loan, an overdraft acts as a flexible credit limit you can draw from at any time — and you only pay interest on the amount you actually use.

Funds can be transferred instantly to your business transaction account, making an overdraft a practical tool for managing cashflow, paying suppliers, covering shortfalls, or keeping operations running smoothly. In many ways, it’s similar to a business line of credit.

Because of this flexibility, business overdrafts are used across almost every industry for working capital, inventory purchases, seasonal demand, and general business expenses.

What You Get With a Business Overdraft

✓ Credit limits typically range from $2,000 to $2 million – however, at Broker.com.au we have originated and settled much larger deals.

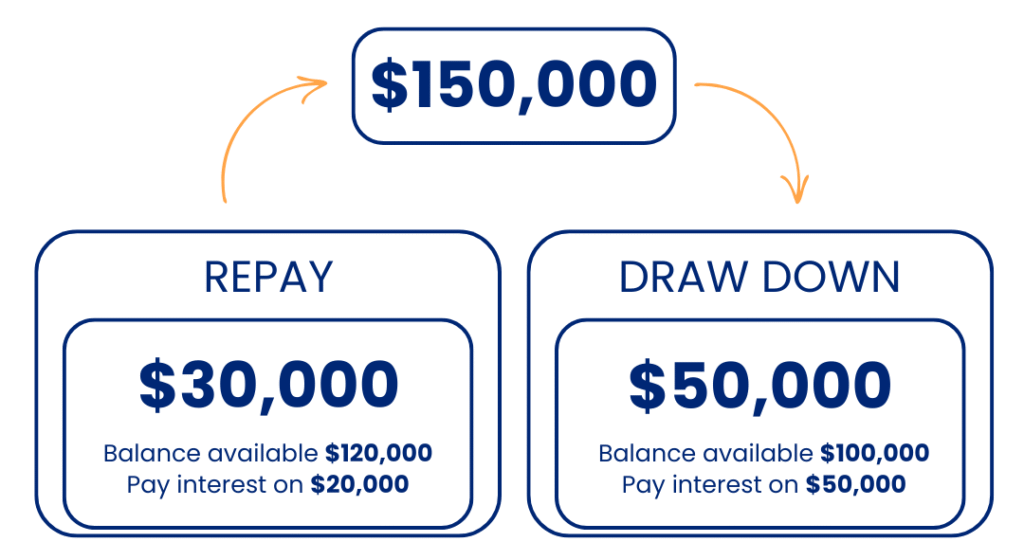

✓ Interest only charged on the balance drawn

✓ Secured and unsecured options

✓ Application fees and/or annual line fees may apply

✓ Approval based on business turnover and credit profile

✓ Generally faster to set up than a traditional loan

✓ Offered by both banks and specialist non-bank lenders

How a Business Overdraft Works

Many business owners still associate overdrafts with the banks — a facility attached to a transaction account. While some operate this way, today’s market also includes a growing number of non-bank lenders offering fast, digital overdraft solutions with instant access to funds.

Here’s how Broker.com.au’s business finance specialist Shelly Raphael explains it:

“Think of a $50,000 overdraft. Instead of being handed the full $50,000 upfront and making fixed repayments, the limit simply sits there ready to use. You might draw down $20,000 today to buy stock, and the funds appear instantly in your business account. You only pay interest on the amount you’ve withdrawn — not the entire limit.”

This structure makes overdrafts ideal for businesses that experience fluctuating cashflow or need quick access to working capital.

Business Overdraft Interest Rates

Overdraft interest rates in 2025 generally range between 11.95% p.a. and 25.00% p.a. for SME Lenders, depending on the lender, business turnover, creditworthiness, and whether the facility is secured or unsecured.

Banks may advertise lower rates, but these are usually reserved for highly established businesses with strong financials.

Below is a summary of common overdraft rates and limits from well-known lenders (at the time of writing):

| Lender | Rates From | Overdraft Limits |

| ANZ | 15.95% p.a. | $2,000 – $300,000 |

| Beyond Bank | 12.99% p.a. | From $10,000 |

| Dynamoney | 14.35% p.a. | $5,000 – $250,000 |

| Great Southern Bank | 14.45% p.a. | Up to $50,000 |

| NAB | 15.75% p.a. | $5,000 – $50,000 |

| Shift | 14.95% p.a. | $25,000 – $1 million |

| Suncorp | 15.24% p.a. | Up to $50,000 |

| Westpac | 12.96% p.a. | Up to $250,000 |

Rates subject to change. For current pricing, speak with a Broker.com.au specialist.

Why Businesses Use Overdrafts

1. Managing Seasonal Cashflow

Industries with unpredictable or cyclical trade — like retail, hospitality, wholesale, agriculture or services — use overdrafts to smooth out quiet periods.

2. Always-On Access to Working Capital

A business overdraft acts as a permanent cash buffer, always available to cover operational needs.

3. Emergency Reserve

Many business owners maintain an overdraft purely as a safety net for unexpected expenses.

4. Simple & Cost-Effective

Once approved, you can draw down multiple times without reapplying. You pay interest only on what you use.

Using an Overdraft for Ongoing Growth

Shelly from Broker.com.au explains how overdrafts support long-term expansion:

“If a business is planning a six-month growth push — hiring staff, scaling marketing, opening a new location — an overdraft is ideal. You might set a $150,000 limit but only draw what you need month by month. There’s no reason to pay interest on the whole amount if you’re not using it yet.”

This flexibility is what makes overdrafts a popular alternative to traditional business loans.

Business Overdraft vs Term Loan

A business overdraft is generally suited to ongoing, short-term, or unpredictable funding needs, while a term loan is better for one-off purchases or fixed investments.

Overdrafts are great for:

‣ Irregular cashflow

‣ Payroll and invoices

‣ Purchasing inventory

‣ Emergencies

‣ Short-term working capital needs

Term loans are better for:

‣ Buying equipment

‣ Expanding into new premises

‣ Long-term strategic investment

Across the market, overdraft rates tend to be higher than unsecured business loans — typically by around 2% p.a. according to Reserve Bank data — but the flexibility often makes overdrafts more cost-effective for short-term use.

7 Steps to Getting a Low-Cost Business Overdraft

1. Compare options — don’t just go to your main bank

Rates and fees differ significantly between lenders.

2. Look for low fees

Expect setup fees plus line/facility fees (monthly, quarterly, or annually).

3. Shop for the lowest rate you qualify for

Rates depend on turnover, trading history, and credit profile.

4. Decide between secured vs unsecured

Secured overdrafts (usually property-backed) offer lower rates.

5. Choose an appropriate term

Terms vary from 3 months to 5 years, or revolving lines with no fixed term.

6. Understand the repayment structure

Banks may let you repay only when cash hits the account; specialist lenders may require minimum principal repayments.

7. Select the right limit

Higher limits may increase fees — don’t take on more than you need.

Am I Eligible?

Most lenders require you to:

✓ Have a valid ABN

✓ Be a sole trader, company, trust or partnership

✓ Be an Australian citizen or permanent resident

✓ Have been trading 6–12+ months

✓ Meet minimum turnover requirements

✓ Have a reasonable credit history

✓ Use the funds for business purposes

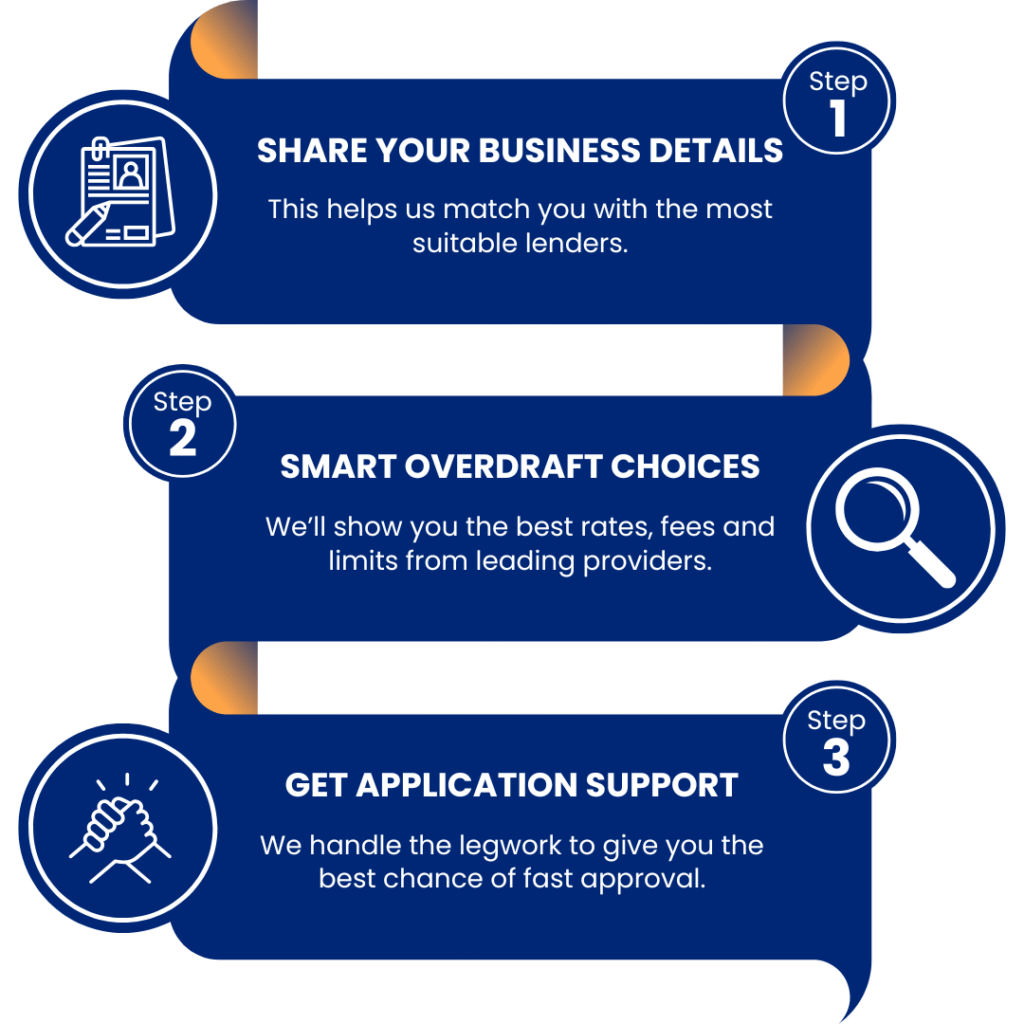

How to Apply

Most non-bank lenders make it simple to apply online.

The approval difference can be significant:

‣ Non-bank lenders: approval in as little as 24 hours

‣ Major banks: 4–6 weeks is common

For limits under $150,000, many lenders require only business bank statements and a director’s guarantee.

Secured vs Unsecured Overdrafts

Secured Overdraft

→ Backed by property or another significant asset

→ Lower interest rates

→ Higher approval amounts

Unsecured Overdraft

→ No specific asset required

→ Faster approval

→ Higher interest rates

→ Similar to a high-limit business credit card

Typical Overdraft Fees

You may encounter:

‣ Establishment/setup fee

‣ Line/facility fee (monthly/quarterly/annual)

‣ Drawdown fees

‣ Over-limit fees

‣ Account-keeping/service fees

‣ Renewal/review/cancellation fees