Introduction to Business Loan Brokers in Australia

Running a business in Australia is exciting but also financially demanding. From managing day-to-day expenses to funding growth, businesses often require loans to maintain stability or scale operations. This is where loan brokers play a vital role. Many Australian businesses are now turning to loan brokers to find better financing solutions instead of relying solely on traditional banks.

Understanding the Role of Loan Brokers

What Does a Loan Broker Do?

A loan broker acts as a middleman between businesses and lenders. They assess your financial needs, compare different loan products, and match you with the most suitable lender. Instead of filling out multiple applications with various banks, a broker streamlines the process, giving you more options in less time.

Looking for tailored finance solutions? Start your application today here.

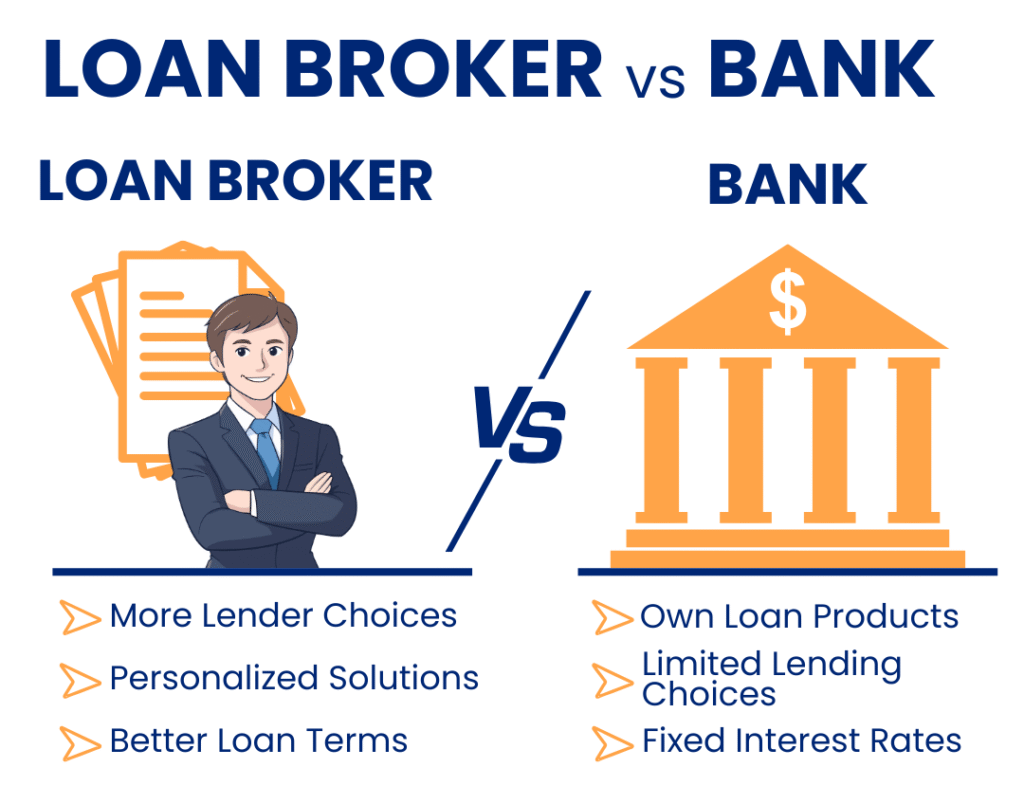

Difference Between a Loan Broker and a Bank

Banks offer loans from their own products only, while brokers give access to a wide network of lenders — including banks, non-bank lenders, credit unions, and private financiers. This means you’re not limited to one institution’s loan criteria.

Benefits of Using a Loan Broker for Australian Businesses

Access to a Wide Range of Lenders

Loan brokers have access to hundreds of lenders across Australia, giving businesses more choices and increasing the chances of approval.

Tailored Loan Solutions for Different Industries

Whether you’re in construction, hospitality, retail, or tech, brokers understand industry-specific needs and can recommend customised loan products.

Saving Time and Reducing Hassle

Instead of spending weeks researching lenders and filling out forms, a broker handles the paperwork and negotiations for you.

Negotiating Better Loan Terms and Rates

Brokers often have strong relationships with lenders, allowing them to secure better interest rates, repayment terms, and loan flexibility compared to going directly to a bank.

Find out what rates and terms your business can access—apply online here.

Why Businesses in Australia Prefer Loan Brokers

Understanding the Australian Lending Market

Australia has a competitive financial market with strict regulations. Loan brokers stay updated on market trends and compliance rules, ensuring businesses make informed decisions.

Support for Startups, SMEs, and Large Enterprises

Startups and SMEs often struggle to secure loans due to limited credit history. Loan brokers help by connecting them with alternative lenders who are more flexible than traditional banks.

Common Misconceptions About Loan Brokers

Are Loan Brokers More Expensive?

Some business owners worry that using a broker adds extra costs. In reality, brokers often save money by negotiating lower rates and structuring better deals. Many earn commissions from lenders rather than charging clients directly.

Do Brokers Only Work With Certain Banks?

A good broker works with multiple lenders, not just one or two. This independence ensures you get the best possible loan for your business needs.

Case Studies: Australian Businesses That Benefited from Loan Brokers

Small Business Success Story

A Melbourne café owner needed funding to expand. By using a loan broker, they secured a low-interest loan tailored for hospitality businesses, something their regular bank had declined.

Large Enterprise Loan Strategy

A logistics company in Sydney required millions in financing for new equipment. A broker connected them with both traditional banks and asset finance lenders, ensuring they got the best long-term deal.

Choosing the Right Loan Broker in Australia

Key Qualities to Look For

- Accreditation and licenses under ASIC regulations

- Experience with businesses in your industry

- Strong lender network and proven track record

- Industry Awards won by the Broker

- Client reviews, such as Google Reviews or Trustpilot

Questions to Ask Before Hiring a Loan Broker

- What lenders do you work with?

- How do you get paid — by me or the lender?

- Can you provide client testimonials?

FAQs About Loan Brokers in Australia

1. Are business loan brokers regulated in Australia?

Not always. There is no regulation is business lending for brokers in Australia. However, reputable brokers hold an Australian Credit Licence (ACL) or are authorised representatives under an ACL or via ASIC regulations.

2. Do loan brokers work with startups?

Absolutely. Some brokers specialise in helping startups and small businesses secure funding. The team at Broker.com.au have experience with startups.

3. How long does it take to get a loan through a broker?

The timeline varies but is often faster than applying directly through banks, thanks to the broker’s network. For small business loans, the team at Broker.com.au have settled loans within 24 hours. Bigger loans tend have more complexity and can take a number of weeks.

4. Can brokers help with bad credit businesses?

Yes, brokers often work with lenders who are open to financing businesses with poor credit histories. Broker’s can also recommend 3rd party businesses who specialise in tidying up bad credit files.

5. Do I pay extra fees when using a broker?

Many brokers are paid by the lender, though some may charge a service fee. It often depends on the complexity of the loan application and additional services provided by the broker, such as tailored advisory, financial modelling etc. Always ask upfront.

Conclusion: The Value of Loan Brokers for Business Growth

For Australian businesses, securing the right loan can make or break growth opportunities. A loan broker acts as a trusted partner, helping businesses save time, access more options, and secure better deals. Whether you’re a startup, SME, or large enterprise, working with a loan broker can be the smartest financial decision for long-term success.

👉 To explore more about loan brokers, visit broker.com.au to see how we can help.

Ready to secure the right loan for your business? Apply now through our simple online form here.