November 2025 Economic Update: Inflation Shock Halts RBA’s Rate-Cutting Cycle

Unexpected inflation has forced the Reserve Bank of Australia (RBA) to pause its long-anticipated easing cycle. In this month’s Broker.com.au economic update, we examine how this surprise shifts the outlook for interest rates, what’s driving Australia’s persistent property price momentum, and how international events — including the US government shutdown and a major minerals partnership — are shaping the broader economic landscape.

Inflation Surprises to the Upside

Australia’s inflation print for September 2025 caught most analysts off guard.

Key Inflation Figures (Annual to September 2025)

| Measure | Latest | Prior | Market Forecast |

| Monthly CPI (YoY) | 3.5% | 3.0% | 3.1% |

| Underlying Inflation | 3.0% | 2.7% | 2.7% |

Housing and transport costs drove the bulk of the increase. Importantly, the rise in underlying inflation marks the first quarterly acceleration since late 2022.

With inflation clearly not moderating as expected, the RBA’s early November decision to hold the cash rate at 3.60% came as no surprise.

Is the RBA’s Easing Cycle Over?

Not necessarily — but the path forward has become more complicated.

Economists still see a scenario where the RBA resumes rate cuts in 2026, but it requires one or both of the following:

- Inflation returning inside the RBA’s 2–3% band, and

- A softer labour market to reduce demand-driven price pressure.

Labour Market Snapshot

| Month | Unemployment Rate |

| August 2025 | 4.3% |

| September 2025 | 4.5% |

| October 2025 | 4.3% (down again) |

| December 2025 Forecast | 4.2% |

While unemployment has lifted off its lows, it remains well below levels typically associated with monetary easing. Without a more meaningful rise, the RBA may be reluctant to cut prematurely.

Bottom line:

Further rate cuts in 2026 remain possible — but inflation must first demonstrate genuine and sustained cooling. And this is the unknown. We will likely need to wait until Feb 2026 to get a better understanding of inflation.

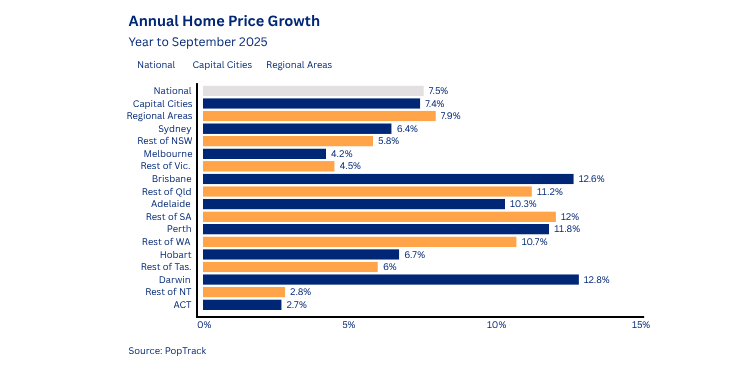

Property Prices Continue to Climb

Despite sticky inflation and rate uncertainty, Australian property prices continue to rise.

Annual Property Price Growth – by PropTrack

Demand continues to run ahead of supply:

- Sales activity: up 3.1% above average

- Listings: 18% below average

Government support schemes (like the expanded First Home Buyer Guarantee) and earlier expectations of rate cuts have helped fuel demand. However, the latest inflation spike may cause near-term buyer caution.

Construction Approvals Rebound

The supply outlook improved slightly in September, with both private house approvals and total dwelling approvals rising.

September 2025 Building Approvals

| Category | Monthly Change | Annual Change |

| Private House Approvals | +4.0% | — |

| Total Dwelling Approvals | +12.0% | +15.3% |

Victoria and New South Wales led the recovery, showing growth of 41.3% and 30.4% respectively.

The US Government Shutdown Becomes the Longest in History

As of 5 November, the United States government shutdown entered its 36th day — now the longest ever recorded.

Shutdown at a Glance

| Impact Area | Key Effect |

| Federal Workforce | 670,000 furloughed, 730,000 unpaid |

| Small Business Loans | Major delays |

| Food Assistance | Interrupted |

| Air Travel | Widespread delays/cancellations |

Economic Impact

The shutdown is expected to shave 1–2% off US GDP growth in Q4 2025.

Permanent economic losses are estimated at US$7–14 billion.

While some activity will rebound post-shutdown, the disruption adds a layer of global economic uncertainty. And even though our little island is a long way from the USA, when the US sneezes, economically at least, we catch a cold. SO we need to keep monitoring their situation.

Australia and the US Forge a Critical Minerals Partnership

Amid the turmoil, Australia and the United States strengthened economic and defence ties with a landmark agreement focused on critical minerals and rare earths.

Key Features of the Minerals Framework

| Component | Details |

| Governments’ Investment Commitment | US$1B each |

| Total Priority Project Pipeline | US$8.5B (next six months) |

| Purpose | Secure supply chains for defence & advanced technologies |

| Strategic Alignment | Supports AUKUS and long-term technology cooperation |

This agreement is expected to enhance Australia’s role as a reliable supplier of critical minerals while attracting long-term investment into the sector.

Economic Outlook: Balanced on Inflation’s Trajectory

While the unexpected inflation spike has halted the RBA’s easing cycle for now, the broader outlook for 2026 still hinges on how quickly inflation cools. If price pressures begin to moderate and labour market conditions loosen further, rate cuts remain a realistic prospect.

In the meantime, rising house prices, strengthening construction activity, and global developments — from the US shutdown to the critical minerals alliance — will continue to shape Australia’s economic landscape heading into the new year.