Interest Rate Outlook – September 2025

Share the News

Current Interest Rate and Recent RBA Decision

As of mid-August 2025, the Reserve Bank of Australia (RBA) has reduced the cash rate to 3.60%, following a third 25 basis-point cut this year after earlier reductions in May and July. The cash rate is now at its lowest level in two years.

Looking to take advantage of lower interest rates? Start your loan application with Broker.com.au today

Governor Michele Bullock reiterated that policy will remain data-dependent, with the board monitoring inflation and labour market conditions closely. While inflation has slowed overall, risks remain, and further adjustments will be considered on a meeting-by-meeting basis.

Key Points (September 2025 Update)

- The RBA cut the cash rate by 25 basis points in August to 3.60%, its lowest level in two years.

Annual inflation (monthly CPI) rose to 2.8% in July, higher than the June quarter’s 2.1%, showing lingering price pressures.

National home values climbed 0.9% in the August quarter, extending the housing market recovery.

The unemployment rate held at 4.2% in July, highlighting stability in the labour market despite softer growth.

Australia’s Latest GDP and Consumption Data

Today’s national accounts show the economy growing faster than expected. Real GDP rose 0.6% in Q2, the sharpest pace in nearly two years, lifting annual growth to 1.8%. Household consumption was the standout, climbing 0.9%, though the household savings ratio slipped from 5.2% to 4.2%. Business investment and government spending were flat, underscoring the reliance on consumer demand to keep momentum ticking over.

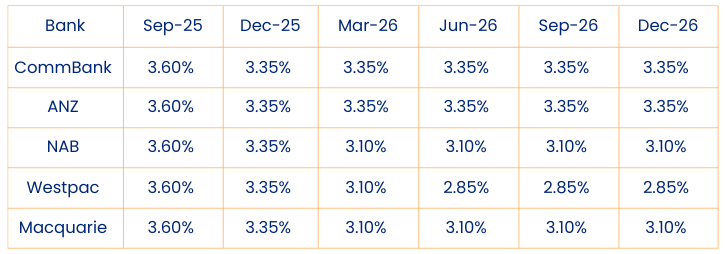

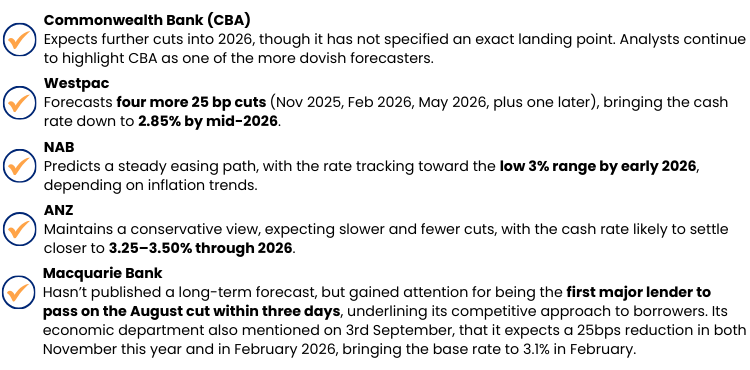

Forecasts from Big Four Banks + Macquarie Bank

What It Means for Borrowers and Property

Mortgage relief: A standard $700,000 loan will save borrowers about $1,100 annually from the August cut.

Housing market: With values already rising 0.9% in Q2, analysts expect cheaper borrowing costs to accelerate the recovery.

Labour market: A 4.2% unemployment rate provides some buffer, but sluggish productivity means the RBA is unlikely to move too aggressively.

With lenders easing rates, now’s the time to review your home or investment loan. Get started here and explore your options with Broker.com.au.

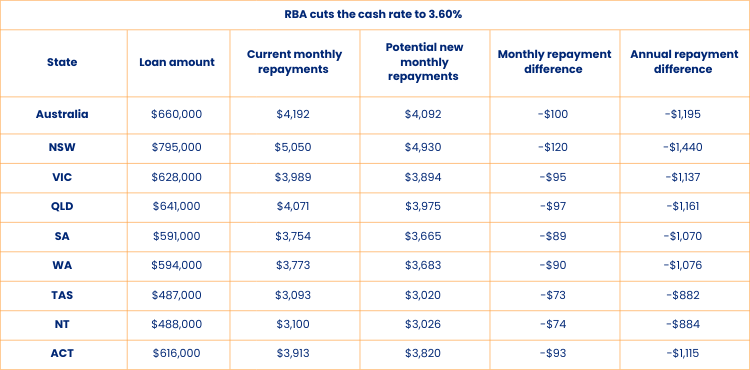

Mozo.com.au recently published an article showing that if lenders passed on August’s rate cut, the average home loan repayments should have reduced by the following:

Source: mozo.com.au Based on 25 year terms, Owner Occupier Principal & Interest. Average Owner-Occupier Variable Housing Rate estimate of 5.85% (using 25bp less than 6.10% as of April 2025 Lenders’ Interest Rates, RBA), and $660,000 as the average loan size for owner occupier dwellings (Lending Indicators, ABS, March Quarter 2025).

It is still clear that the environment remains unclear! The Governor and the RBA Board will be watching all economic data metrics very closely, as they always do, and are likely to be reactive to any market forces that impact inflation. So although the big 4 banks and Macquarie are predicting some further rate cuts ahead for Aussie borrowers, it should be treated with a dose of the old “suck it and see” approach.

Ready to make your next property move while rates are low? Apply now and let Broker.com.au help you find the right finance solution.

Written by Matt Board – CEO of Broker.com.au (updated 3rd September 2025)

At Broker.com.au, we’re here to help you navigate the shifting interest rate environment and understand what it means for your home loan or investment strategy. Whether you’re refinancing, purchasing property, or simply wanting clarity on your next steps, our team is only a call away.

For more expert insights on business lending, industry trends, and financial strategies, check out our full Media and News page.