When purchasing a vehicle in Australia, it’s important to factor in stamp duty—a government levy applied to various transactions, including vehicle purchases. While commonly referred to as “government charges,” stamp duty is a mandatory cost collected by state and territory revenue offices.

What is Motor Vehicle Stamp Duty?

Stamp duty on motor vehicles (sometimes known as Motor Vehicle Duty or Vehicle Registration Duty) is a state-based tax applied during the registration or transfer of ownership of a vehicle.

If you’re buying from a licensed dealership, they typically handle the stamp duty payment on your behalf. For private sales, however, the responsibility to pay the duty falls on the buyer.

Certain exemptions and discounts may be available depending on how and why the vehicle is registered. For detailed information, it’s best to consult the relevant revenue authority in your state or territory.

Planning to buy a car? Start your application with Broker.com.au and explore finance options tailored to you.

How Much Stamp Duty Will You Pay?

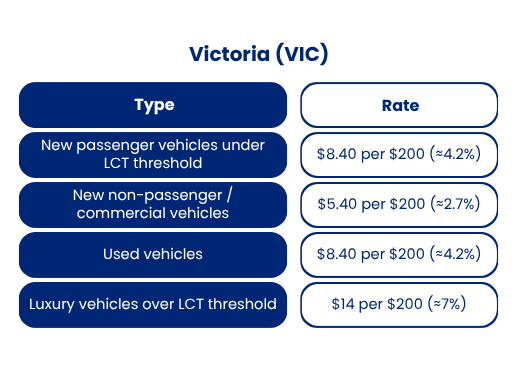

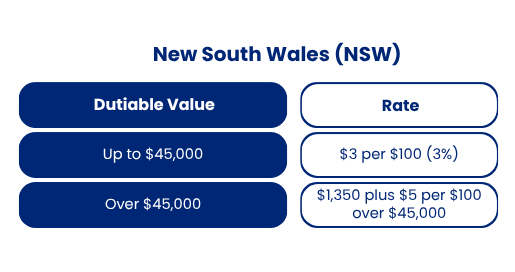

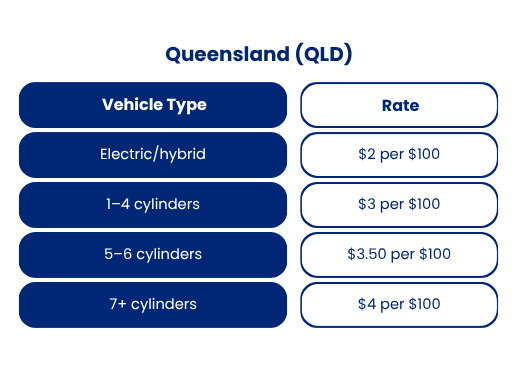

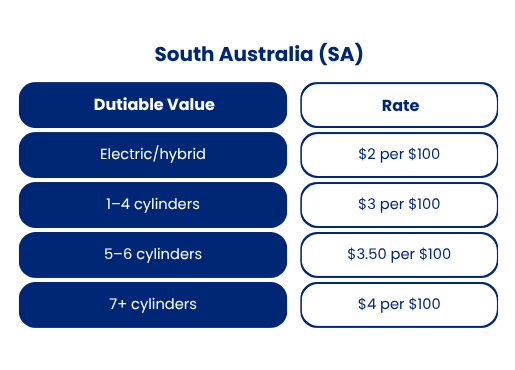

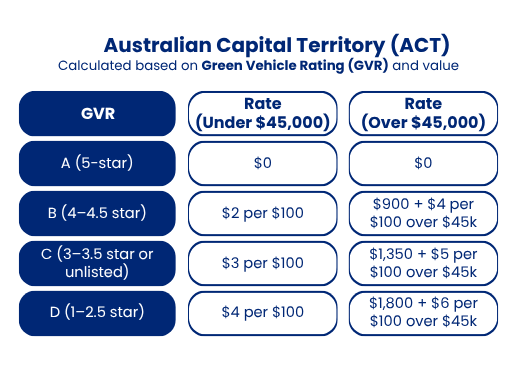

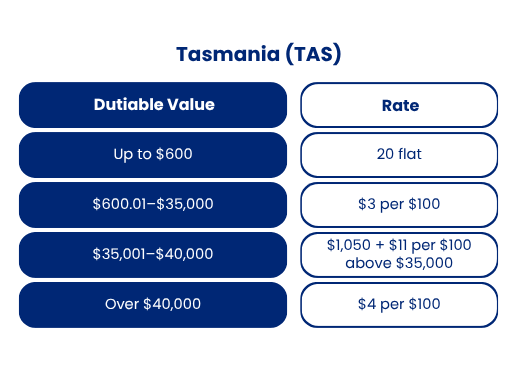

Stamp duty is calculated based on the dutiable value of the vehicle, typically the higher of the purchase price or the market value. Different states and territories have different calculation methods and thresholds.

Below is a 2024–2025 breakdown of motor vehicle stamp duty by region.

Stamp Duty Rates by State (2024–2025)

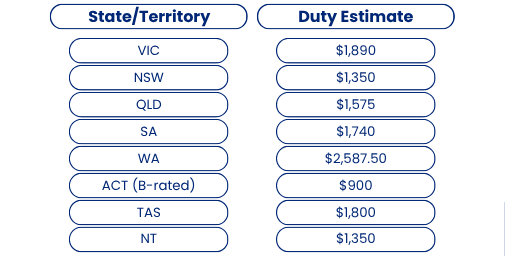

Example Calculation

Vehicle: New 6-cylinder petrol sedan

Dutiable Value: $45,000

Estimated Stamp Duty (2024):

Want to make your next vehicle purchase more affordable? Apply online today and we’ll help you compare the best loan options.

Need Help Reducing Costs?

While stamp duty is unavoidable, Broker.com.au can help you cut back on your overall car expenses by finding competitive finance and insurance solutions.

📞 Call us today at 1300 373 300

🌐 Or get started online at Broker.com.au

Useful Links – Revenue Offices by State

VIC: www.sro.vic.gov.au

NSW: www.osr.nsw.gov.au

QLD: www.osr.qld.gov.au

TAS: www.sro.tas.gov.au

Ready to take the next step? Get started on your application here and let Broker.com.au guide you through the process.